Every year, Americans spend over $700 billion on prescription drugs. But here’s the twist: 90% of all prescriptions filled are for generic drugs-and they cost just 12% of what brand-name drugs do. That’s not a rounding error. That’s a $482 billion savings in 2024 alone. If you’ve ever wondered why your pharmacy bill dropped when your doctor switched you from a brand-name pill to a generic, this is why. Generic drugs aren’t just cheaper copies. They’re the single biggest reason the U.S. healthcare system hasn’t collapsed under the weight of drug prices.

How generics cut costs without cutting corners

Generic drugs aren’t experimental. They’re exact copies of brand-name medications in active ingredients, dosage, strength, and how they work in the body. The FDA requires them to meet the same strict standards. The only differences? The shape, color, or inactive ingredients like fillers-and the price. A generic version of Lipitor (atorvastatin) costs about $10 a month. The brand version? Over $300. That’s not a discount. That’s a revolution. In 2024, 3.9 billion generic prescriptions were filled in the U.S. That’s 9 out of every 10 pills. Yet they made up only 12% of total drug spending. Meanwhile, brand-name drugs-just 10% of prescriptions-drained $700 billion from the system. That’s not a coincidence. It’s math. And it’s the same pattern every year since 2016. As more generics hit the market, the cost share keeps falling. In 2019, generics cost $131 billion. In 2024, they cost $98 billion-even though more people were using them.The biosimilar breakthrough

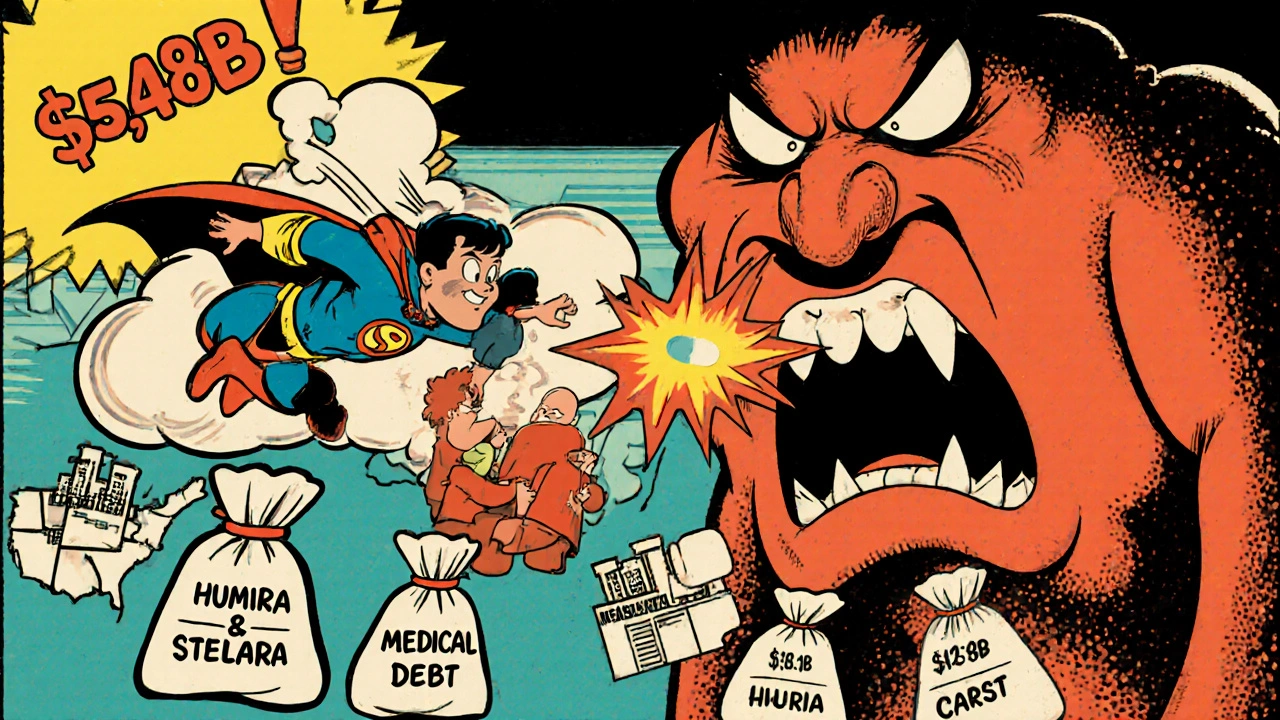

Biosimilars are the next wave. They’re not exact copies like traditional generics, but they’re highly similar to complex biologic drugs-like Humira, Enbrel, or Stelara-that treat arthritis, cancer, and autoimmune diseases. These drugs used to cost $70,000 a year. Now, biosimilars are hitting the market at 80% less. In 2024, Humira biosimilars went from being used in just 3% of cases to 28%. That shift saved health plans billions. Stelara, a $6 billion-a-year drug, now has seven biosimilar competitors. Once fully adopted, they’re expected to save $4.8 billion annually. Since 2015, biosimilars have enabled over 460 million extra days of patient therapy. That means more people got treatment they couldn’t afford before. And it’s not slowing down. The problem? 90% of biologics losing patent protection in the next 10 years have no biosimilar in development. That’s a $234 billion missed opportunity. If we don’t fix that, the savings engine could stall.Why brand-name drugs cost so much

Brand-name drugs aren’t expensive because they’re better. They’re expensive because companies protect their patents. One common tactic? “Pay for delay.” That’s when a brand-name company pays a generic manufacturer to stay off the market. In 2024, brand-name drugmakers spent an average of $1.2 billion per year on these settlements. That’s not innovation. That’s market manipulation. Americans pay more than three times what people in other OECD countries pay for the same brand-name drugs. Take insulin. Eli Lilly’s Humalog cost $275 a vial in 2020. After public pressure and Medicare reforms, they dropped it to $25. That’s not because the cost of production changed. It’s because the system finally cracked under pressure.

Real people, real savings

Behind every dollar saved is a real person. A Reddit user in r/Pharmacy shared that switching from brand-name albuterol to generic saved them $300 a month. Another said their diabetes meds went from $400 to $15. GoodRx found that 1 in 12 Americans have medical debt from prescription costs. For many, the only thing standing between them and skipping doses is a generic version. Medicare data shows that less than 1% of beneficiaries who hit the catastrophic coverage phase use only generics. That tells you something: the high-cost brand-name drugs are what push people into debt. When a senior has to choose between insulin and groceries, it’s not because they’re irresponsible. It’s because the system let them down.What’s next: Policy and potential

The Inflation Reduction Act gave Medicare the power to negotiate drug prices. Starting in 2026, 30 drugs per year will be up for negotiation. The Congressional Budget Office estimates this could save $500-550 billion over a decade. If extended to Medicaid and private insurance, total savings could hit $1 trillion. The White House’s Most-Favored-Nation deal with Eli Lilly and Novo Nordisk cut Ozempic from $1,000 to $350 and Wegovy from $1,350 to $350. That’s not just a price cut. It’s a signal. The market is changing. And generics are leading the way. By 2030, if current trends continue, generic and biosimilar use could reduce total U.S. drug spending by 15-18%. That’s $100+ billion saved every year. The industry already supports 350,000 jobs. The manufacturing plants are spread across 46 states. This isn’t some fringe movement. It’s the backbone of affordable care.

Understanding the Link Between Heart Arrhythmias and Sudden Cardiac Arrest

Understanding the Link Between Heart Arrhythmias and Sudden Cardiac Arrest

The Connection Between Tendonitis and Lyme Disease: What You Need to Know

The Connection Between Tendonitis and Lyme Disease: What You Need to Know

Why Generic Drug Prices Vary So Much Between States

Why Generic Drug Prices Vary So Much Between States

Generic Drug Concerns: Myths vs. Reality for Safety and Efficacy

Generic Drug Concerns: Myths vs. Reality for Safety and Efficacy

Tips for ensuring proper hygiene while using brimonidine tartrate eye drops

Tips for ensuring proper hygiene while using brimonidine tartrate eye drops

Erin Nemo

December 2, 2025 AT 21:59My insulin went from $400 to $15 with a generic-no joke, I cried in the pharmacy. This isn’t just math, it’s survival.

ariel nicholas

December 3, 2025 AT 22:12Oh, so now we’re glorifying Chinese-made pills because they’re cheap?!! The FDA? Ha! They approve generics faster than a drunk intern at a karaoke bar-while our own pharma workers get laid off! This isn’t progress-it’s surrender!!

Rachel Stanton

December 4, 2025 AT 18:37It’s critical to recognize that generics aren’t just cost-cutting-they’re equity infrastructure. The bioequivalence standards enforced by the FDA are among the most rigorous in global health policy. When we talk about access, we’re not just talking about price points; we’re talking about therapeutic continuity, adherence rates, and downstream reductions in hospitalizations. The 90% penetration rate? That’s a public health win, not a corporate loophole.

And biosimilars? They’re the next frontier in biologic accessibility. The fact that Humira biosimilars went from 3% to 28% adoption in five years shows that market dynamics can shift when policy aligns with patient need. But we still need to dismantle PBM rebates and formulary restrictions that disincentivize substitution.

This isn’t anti-pharma. It’s pro-patient. And we need to stop letting brand-name lobbying masquerade as innovation.

Amber-Lynn Quinata

December 6, 2025 AT 17:45Ugh. I just saw my neighbor’s kid on a generic ADHD med and he’s so spaced out 😔 I mean, how do we KNOW they’re not just sugar pills with a different color? I’ve read things. Things people don’t want you to know. 🤫💊

Lauryn Smith

December 7, 2025 AT 05:48I switched my mom to generic Lipitor last year. She’s been on it for 6 months now-no side effects, her cholesterol is down, and she’s saving $280 a month. If your doctor hasn’t asked you about generics, ask them. It’s not complicated. It’s just common sense.

Edward Hyde

December 7, 2025 AT 22:21Generic drugs? More like generic BS. Big Pharma’s got the whole system on a leash and you’re clapping like a chimp who just got a banana. You think the FDA’s clean? Try reading the 1,200 warnings last year-half of them were for shit that’d get a kid kicked out of a meth lab. And don’t even get me started on the ‘biosimilar’ fairy tale. It’s all just repackaged snake oil with a new label.

Charlotte Collins

December 8, 2025 AT 12:14The data looks good on paper, but let’s not romanticize the supply chain. Most generics are manufactured in India and China-countries with lax environmental regulations and labor practices. The $98 billion savings? That’s subsidized by exploited workers and polluted rivers. We’re outsourcing our health crises abroad while patting ourselves on the back. The real cost isn’t on your receipt-it’s in the groundwater.

Bonnie Youn

December 8, 2025 AT 22:05You’re not just saving money-you’re saving lives. My aunt skipped her meds for two years because of cost. The day she switched to generic metformin? She started walking again. That’s not a statistic. That’s a miracle. Keep pushing. Keep asking. Keep fighting. We’ve got this.

Margaret Stearns

December 9, 2025 AT 10:27I always ask my pharmacist if there’s a cheaper option. Sometimes they swap it without telling me. Last month I got a different generic for my blood pressure pill and I felt weird for a week. Not sure why. Maybe it was the filler? Anyway, I’m gonna start asking for the exact brand name next time. Just to be safe.