Running out of medication isn’t just inconvenient-it can be dangerous. And if you’re juggling multiple prescriptions, the costs can add up fast. In 2025, the average Australian with three chronic conditions spends over $1,800 a year on prescriptions, even with PBS subsidies. That’s why setting up a personal medication budgeting system with auto-refill alerts isn’t a luxury-it’s a necessity.

Start with a clear picture of what you’re spending

Before you automate anything, you need to know where your money’s going. Grab your last six months of prescription receipts, or log into your pharmacy’s online portal. List every medication you take, how often you refill it, and how much each refill costs after any subsidies. Don’t skip the over-the-counter stuff either-things like pain relievers, antacids, or vitamins can add $50-$100 a month if you’re not watching.For example, if you take metformin (monthly cost: $12), lisinopril ($15), and a daily multivitamin ($25), that’s $52 a month, or $624 a year. Add in a monthly inhaler ($45) and you’re at $1,044. That’s not small change. Write this down. Keep it simple: medication, frequency, cost. No need for fancy spreadsheets yet.

Use your pharmacy’s tools-most are free

Most major pharmacies in Australia-Chemist Warehouse, TerryWhite Chemmart, Thompsons, and even your local independent pharmacy-offer free online accounts. Sign up if you haven’t already. Once logged in, you’ll see a dashboard showing your active prescriptions, refill dates, and upcoming costs.Turn on auto-refill alerts. This isn’t just about getting reminded-it’s about locking in your price. Many pharmacies offer price locks for 90-day supplies. If you refill on time, you avoid last-minute rush fees or price hikes. Set alerts for 7 days before your prescription runs out. That gives you time to check your budget, call your doctor if you need a new script, or switch to a cheaper generic if one’s available.

Some apps, like Medisafe or MyTherapy, sync with your pharmacy and send SMS or push notifications. They even track side effects and adherence rates. If you’ve ever forgotten a dose because you were busy, this alone can save you from hospital visits down the track.

Build a monthly medication budget line in your spending plan

Treat your medication costs like your rent or electricity bill. Add it to your monthly budget. If you spend $1,044 a year, that’s $87 a month. Put that amount aside each pay cycle-either in a separate savings account or just as a line item in your budgeting app (like YNAB, PocketGuard, or even a simple Google Sheet).Why does this matter? Because when you see medication costs as a fixed expense, you stop treating them as surprises. You’re not scrambling when your insulin price jumps $10. You’ve already planned for it. And if you get a discount or switch to a cheaper brand, that extra money goes into your emergency fund or gets used to cover another prescription.

Set up smart alerts that actually help

Not all auto-refill alerts are created equal. Basic ones just say, “Your script is due.” Smart ones do more:- Notify you if a generic version is now available

- Alert you if your pharmacy’s price changed since last refill

- Warn you if you’re about to run out before your next doctor’s appointment

- Flag when a medication is going off-patent-meaning a cheaper version will hit shelves soon

Pharmacies like Chemist Warehouse now use AI to predict refill timing based on your history. If you usually refill your blood pressure med on the 12th of every month, they’ll nudge you on the 5th. No more waiting until you’re down to one pill.

Pro tip: Link your alerts to your calendar. Add a recurring event: “Check meds & budget” every first Friday of the month. Spend 10 minutes reviewing what you spent, what you used, and whether you need to adjust. This small habit cuts waste and prevents over-ordering.

Know when to switch to cheaper options

Not every brand-name drug is worth the extra cost. In Australia, PBS-listed generics are often 70-90% cheaper than brand names and just as effective. Ask your pharmacist: “Is there a generic version of this?” or “Will this be cheaper if I switch?”For example, the brand-name statin Crestor can cost $35 a month. Rosuvastatin (the generic) costs $6. That’s $336 a year saved. That’s a holiday, a new pair of shoes, or extra groceries. Don’t feel guilty about switching. Your doctor and pharmacist are there to help you save, not to sell you the most expensive option.

Use the PBS website to check prices. Type in your medication, and it’ll show you the co-payment for concession holders, general patients, and whether a cheaper alternative exists. Bookmark it. Check it every time you refill.

Avoid the hidden traps

There are three common mistakes people make:- Refilling too early-pharmacies often won’t honor a refill until 7-10 days before your supply runs out. Don’t call in advance unless you’re switching pharmacies.

- Ignoring expired scripts-some meds can’t be refilled without a new prescription. If you wait until the last minute, you might be stuck without meds for weeks.

- Buying in bulk without checking stability-some drugs (like insulin or liquid antibiotics) lose potency if stored too long. Only stockpile if your doctor says it’s safe.

Also, watch out for “convenience packs.” These pre-sorted blister packs are great for seniors or people on five+ meds, but they often cost $10-$15 extra per month. Ask if it’s really worth it. Sometimes, a simple pill organizer from the supermarket does the same job for $5.

What to do when costs spike

If your medication suddenly gets more expensive-say, your diabetes drug jumps $20 a script-don’t panic. Do this:- Call your pharmacist. Ask if there’s a therapeutic alternative.

- Check the PBS website for a cheaper brand or generic.

- Ask your doctor if you can switch to a different drug in the same class.

- If you’re on a concession card, you’re already paying the lowest possible rate. If not, consider applying-you might qualify.

Under the PBS Safety Net, once you’ve spent $334.50 (or $71.20 for concession holders) on PBS medicines in a calendar year, your co-payment drops to just $7.10 per script for the rest of the year. Keep track. You might be closer to the cap than you think.

Keep it simple. Keep it consistent.

You don’t need a fancy app or a financial advisor to manage your meds. Just three things:- A list of your meds, costs, and refill dates

- A monthly budget line for prescriptions

- Auto-refill alerts turned on

Do this for three months. You’ll start seeing patterns. You’ll notice when you’re overpaying. You’ll catch price changes before they hit your wallet. And you’ll stop the stress of running out on a weekend.

Medication budgeting isn’t about being tight-it’s about being in control. When you know what you’re spending, when you’ll run out, and how to save, you’re not just managing pills. You’re managing your health, your money, and your peace of mind.

Can I set up auto-refill alerts without a smartphone?

Yes. Most pharmacies offer SMS alerts or even phone reminders. When you sign up for an online account, look for the option to receive refill notifications via text message or automated voice call. You don’t need an app-just a working phone number linked to your pharmacy profile.

What if my doctor changes my prescription?

Update your list immediately. If you’re using a pharmacy app, go into your profile and remove the old medication or mark it as discontinued. Most apps will pause auto-refills for discontinued scripts. If you’re using a paper list, cross out the old one and add the new one with the correct dosage and refill schedule. Never ignore a change-your auto-alerts should reflect your current regimen.

Are auto-refill alerts safe for controlled substances?

Yes, but with limits. Controlled medications like opioids or strong sedatives can’t be refilled automatically under Australian law. Pharmacies must verify your need with your doctor before dispensing. Auto-alerts will still notify you when your script is due, but you’ll need to schedule a consultation before getting the next supply. This is a safety feature, not a flaw.

How do I know if I’m eligible for the PBS Safety Net?

If you’ve spent $334.50 on PBS medicines in a calendar year (as a general patient), you automatically qualify. Your pharmacy tracks this for you. When you reach the cap, your next scripts will cost just $7.10. You can check your progress by asking your pharmacist or logging into your Medicare account online. No application needed-it’s automatic.

Can I use this system if I’m on multiple medications for different conditions?

Absolutely. In fact, this system works best for people on multiple drugs. Start by listing every medication-even the ones you take occasionally. Group them by purpose: heart, diabetes, pain, etc. Then assign each one a refill date and cost. Use your pharmacy’s online dashboard to see all your scripts in one place. Auto-alerts will trigger individually for each one, so you won’t miss anything.

What if I can’t afford my meds even with the PBS?

Contact your local community health centre or speak to your pharmacist. Many offer free or low-cost medication assistance programs. Some pharmaceutical companies have patient support schemes that provide free or discounted drugs for people on low incomes. Don’t skip doses because of cost-there are options. Ask for help.

Next steps: Start today

Here’s what to do in the next 24 hours:- Log into your pharmacy’s online portal.

- Turn on auto-refill alerts for every active prescription.

- Write down your total monthly medication cost.

- Add that amount to your next budget cycle.

- Check the PBS website for cheaper alternatives on any brand-name drugs you’re taking.

That’s it. No apps to download. No complex forms. Just five simple actions that can save you hundreds of dollars and a lot of stress over the next year.

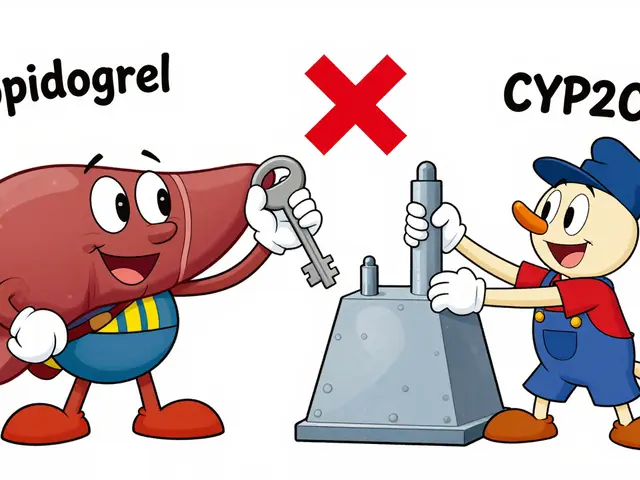

Omeprazole and Clopidogrel: What You Need to Know About CYP2C19 Interaction

Omeprazole and Clopidogrel: What You Need to Know About CYP2C19 Interaction

European Generic Markets: Regulatory Approaches Across the EU in 2025

European Generic Markets: Regulatory Approaches Across the EU in 2025

The History and Development of Chlorthalidone

The History and Development of Chlorthalidone

Understanding Anemia: Causes, Symptoms, and Treatments

Understanding Anemia: Causes, Symptoms, and Treatments

King Over

November 19, 2025 AT 15:28Do it.

Nosipho Mbambo

November 20, 2025 AT 20:49Katie Magnus

November 22, 2025 AT 19:33Johannah Lavin

November 23, 2025 AT 08:49Ravinder Singh

November 24, 2025 AT 07:54Russ Bergeman

November 26, 2025 AT 06:52Dana Oralkhan

November 27, 2025 AT 22:25Jeremy Samuel

November 28, 2025 AT 10:31Destiny Annamaria

November 29, 2025 AT 03:51Ron and Gill Day

November 30, 2025 AT 16:33Summer Joy

November 30, 2025 AT 23:45Aruna Urban Planner

December 1, 2025 AT 02:24Nicole Ziegler

December 2, 2025 AT 14:34Bharat Alasandi

December 2, 2025 AT 23:08